Homeowners Insurance in and around Richfield

Protect what's important from the unanticipated.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

After a stressful day at work, there’s nothing better than coming home. Home is where you relax, wind down and slow down. It’s where you build a life with the ones you love.

Protect what's important from the unanticipated.

Help protect your home with the right insurance for you.

Agent Karl Herman, At Your Service

Karl Herman can walk you through the whole coverage process, step by step. You can have a hassle-free experience to get a protection plan for everything that’s meaningful to you. We’re talking about more than just protection for your home gadgets, furniture and swing sets. Protect your family keepsakes—like pictures and collectibles. Protect your hobbies and interests—like musical instruments and tools. And Agent Karl Herman can share more information about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have home security devices, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

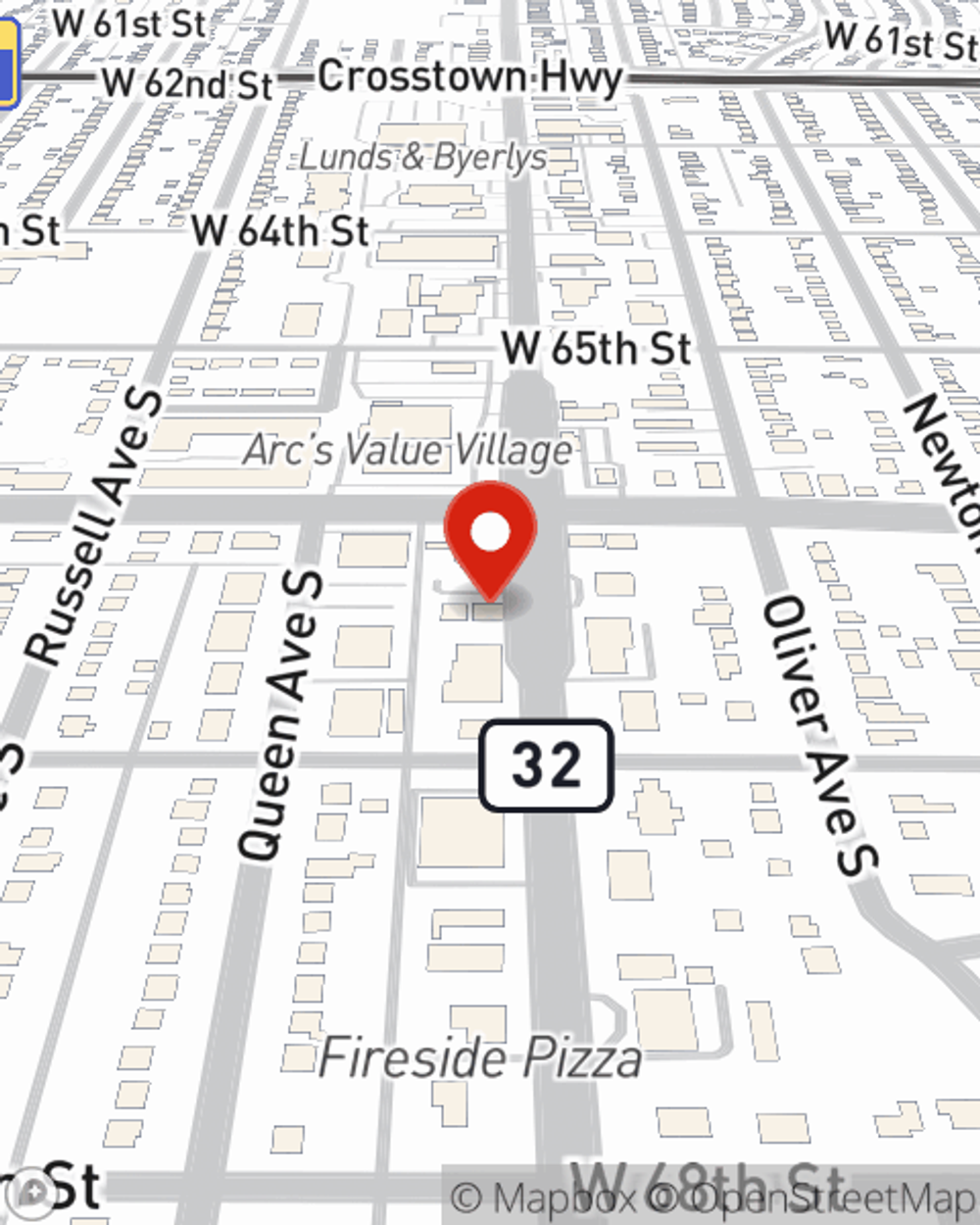

When your Richfield, MN, home is insured by State Farm, even if the unexpected happens, your home may be covered! Call or go online now and find out how State Farm agent Karl Herman can help meet your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Karl at (612) 455-8844 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Karl Herman

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.